🏦Bank customers sue over fees for depositing checks that bounce. Were you charged for a NSF check that was not your fault?

If the Court and judge approves, the payout is estimated to be from $2,000 to $5,000 per *qualified claim.

A bank is a place where they lend you an umbrella in fair weather and ask for it back when it begins to rain.

Have you ever had a deposited check bounce and be slapped with a fee within the last 3 years? It turns out that might be illegal.

You could be entitled to compensation. It costs nothing to find out—see if your bank is on the list and if those sneaky bank fees turn into cash in your pocket.

If you are in California, New York, New Jersey, or Illinois.

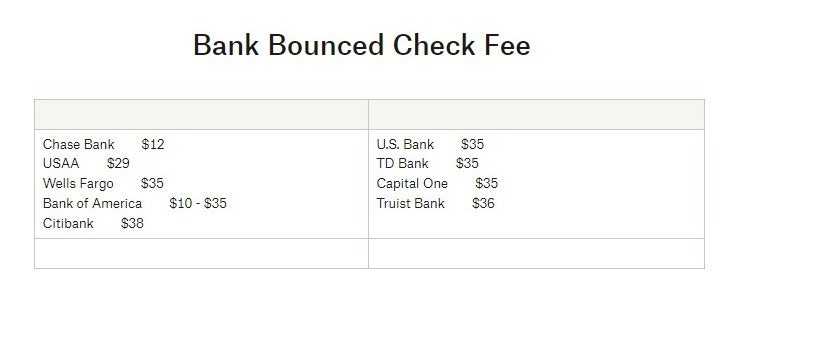

Did your bank charge you a fee for a bounced check? You may be owed SUBSTANTIAL compensation. Bounced check fees, also known as Non-Sufficient Funds (NSF) fees or returned item fees, are charges imposed by banks if you attempt to cash a payment or withdrawal but your account lacks the necessary funds to cover the transaction. These fees typically range from $25 to $50 per bounced check, and these bounced check fees can very quickly add up.

If you deposited a check that was returned and you were charged the NSF feed and you bank with one of the institutions below you may qualify.

Returned Check and Bounced Check Fees

Bounced check fees are plagued by a lack of transparency. Consumers often don't understand what triggers these fees or the exact amount they'll face. This obscurity hinders informed financial decisions and effective budgeting. Worse yet, these fees can snowball into significant sums, even if the consumer takes no further action. Widely varying fee structures add to the confusion. Note: The specific information below may have changed since this article's publication in March 2024

Bounced check fees apply to paper checks and electronic payments if there are insufficient funds in the linked account. This can result in unexpected charges for consumers and catch them off guard.

Have you deposited a check at your bank that someone else gave you in the past 3 years, only to find that it bounced and you were charged a fee? If your answer is yes, you might be owed compensation. If the court and judge approve, the payout is estimated to range between $2,000 to $5,000 per qualified claim. The following banks and states are eligible for a payout:

Attorney Advertising. The information on this website is for general informational and advertising purposes. No attorney-client relationship between reader and Siri & Glimstad or their partner firm is created by submitting the form above. Upon submitting the form, you agree that a representative from Siri & Glimstad or their partner firm may contact you.

Mom quits her corporate job, now works just 5 hours a week and earns over $120,000!

This Week is Packed with Incredible Tales of Business, Finance, and AI Successes: Moms, You'll Love This! Earning Passive Income: The Inspiring Journey of a Mom **Mom says goodbye to her job, now works just 5 hours a week and brings home $120,000 annually!**